This weekend we rejoice Father’s Day. Fathers have the flexibility to offer nice benefits for his or her kids, who arrive on this world completely depending on their dad and mom. I recognize all of the issues my father did for me and wrote about six classes I discovered from my dad in a earlier father’s day message.

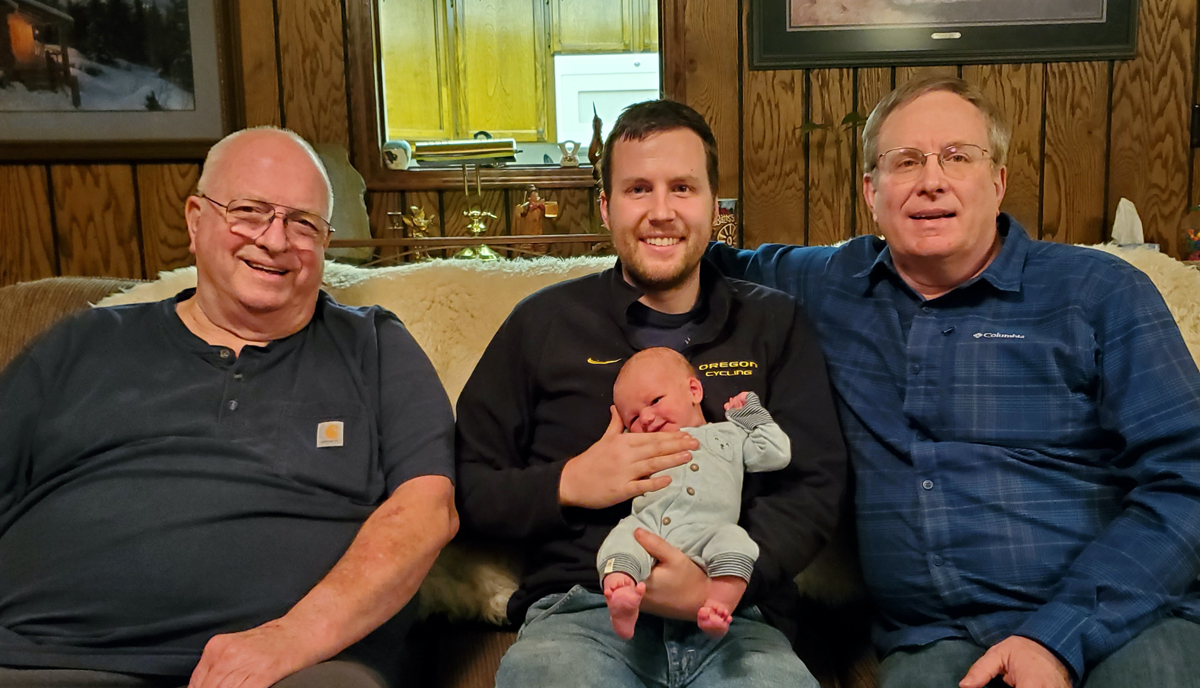

Just a few months in the past, my oldest son had his first little one, so this 12 months he will likely be celebrating his first Father’s Day as a father. When he introduced his son over to fulfill us for the primary time, just a few days previous, you might see the satisfaction and pleasure within the new father’s face. It jogged my memory of the scene in The Lion King the place Simba was held up for everybody to see. It was an emotional second. The image with this text is the 4 generations of Fawcett males.

As I held my first grandchild in my arms, I started to consider the issues my son would want to know as his life modified from that of a husband to the much more demanding function of a father.

When that third individual joins the household, it triggers just a few adjustments in a single’s life. Following is a listing of some issues each new father ought to do at this vital juncture in his life.

1: Replace your will.

Sadly, most new fathers don’t but have a will, so they need to create one at the moment. For many who have already got a will, there are two crucial issues that have to be added. The primary is so as to add your new little one to the checklist of those that are in line to inherit your property within the occasion of your demise.

None of us wish to assume we would die, however every single day, just a few younger fathers move away unexpectedly. Life for these you permit behind will likely be much less aggravating if you happen to die with a will. The desire ought to state that all the things goes to your spouse once you die and within the occasion she just isn’t dwelling, then it goes to your little one.

The opposite factor it’s best to specify is who would be the guardian of your new little one if each dad and mom are gone. After I do a monetary makeover with my teaching shoppers, establishing a will is a crucial a part of reworking their monetary lives. Many dad and mom don’t wish to make a will as a result of they can not resolve who ought to elevate their kids in the event that they die. Who higher to make this tough determination than the dad and mom? If each dad and mom die with out a will the court docket will resolve who will elevate your kids. So don’t delay including a guardian to your will.

Not too long ago, I had a slim escape, as I noticed a big truck within the means of working a crimson gentle, barreling down on my automobile door to T-bone me. Solely my fast swerve and his breaks prevented my will from being learn. As I drove away, I used to be reminded of how rapidly my life may finish with out warning. I can nonetheless image my shut up view of the Ford emblem on his entrance grill. Greater than half of all American adults wouldn’t have a will. Put your self within the different half.

2: Add your little one to your medical health insurance

You’ll assume that is computerized once you add a brand new member to your loved ones, however some insurance policies are just for a single insured member. If you don’t add the kid to a coverage, and pay the extra premium, your little one won’t be coated. You don’t wish to end up within the emergency division of the hospital solely to find your little one just isn’t on the coverage.

3: It’s time for time period life insurance coverage

For those who haven’t bought life insurance coverage but, possibly as a result of each spouses have been working and will deal with themselves within the occasion of the demise of the opposite, now’s the time to get time period life insurance coverage. You now have somebody relying on you to take care of them financially. For those who have been to die, you don’t wish to go away them destitute. Purchase a 20-30 12 months degree time period coverage. If you’re unsure how a lot protection to get, this text will assist.

If you have already got a life insurance coverage coverage, then you definately now must replace the beneficiaries to incorporate your new little one. Your major beneficiary needs to be your spouse, and the secondary beneficiary can be your little one. You additionally have to be positive the coverage is sufficiently big to fulfill the altering wants as your loved ones grows over time.

4: Ensure you have got sufficient incapacity insurance coverage

For those who don’t have any incapacity insurance coverage, now’s the time to get some. Your little one is relying in your revenue to outlive. For those who develop into disabled, they are going to undergo as nicely. You must have a coverage that can pay if you happen to can not carry out your present occupation.

You probably have a coverage that you simply purchased some time again ensure you have sufficient protection.

5: Replace beneficiaries on all of your accounts

Nearly each funding account you personal will request a listing of beneficiaries. It is rather seemingly that you simply solely have your spouse listed because the beneficiary. Now you’ll be able to add your little one as a secondary beneficiary in case your spouse have been to die earlier than or concurrently you.

It is a place the place issues get missed. There are sometimes many accounts that want updating and also you wish to ensure you modify all of them. Checking and financial savings accounts, certificates of deposit, retirement plans, IRAs, deferred compensation plans, brokerages accounts, insurance coverage accounts, companies, and the rest you’ll be able to consider must be up to date.

6: Beef up your emergency fund

You probably have established an emergency fund as six months of your dwelling bills, don’t overlook that these dwelling bills simply went up. Work out what your new funds will seem like and the way a lot additional you will want to place within the emergency fund to carry it according to your new six month expense quantity.

You don’t wish to fall quick within the occasion of a job loss or some other black swan that comes alongside to throw a wrench in your plans.

7: Save adequately in your retirement

It’s your job to deal with the monetary wants of your little one, not the opposite method round. You don’t wish to develop into a monetary burden to your little one if you find yourself in your retirement years. Nevertheless, there’s a good likelihood your little one will want that can assist you as you age, develop into weaker, lose your stability, or can’t bear in mind issues anymore. In any case, you helped them with this stuff once they wanted it.

Please don’t spend all of your cash whereas incomes a dwelling so nothing is left for retirement. Your little one ought to have the opportunity that can assist you use your individual cash to deal with your retirement years. They need to not must dip into their funds to pay your payments. Ensure you can stand by yourself financially for the remainder of your life.

8: Begin saving for his or her faculty

Giving your little one a debt free training is such a terrific blessing. Many individuals get strapped with scholar debt lately making it very onerous to dig their method out as they start their profession. Blessing your kids with a financial savings account for his or her faculty training is such a terrific reward.

I used to be very proud to have each of my sons be capable to get their bachelor levels with out having the burden of debt hanging over them. There are plenty of docs who earned much more than I who have been unable to provide their youngsters this head begin on their monetary future.

9: Plan to be an enormous a part of their life

Physicians have a troublesome work schedule. I used to be a resident when my first little one was born and I’d typically go days with out even seeing him. It’s onerous to develop a relationship with somebody you by no means see. Make it some extent to prioritize your kids in your life.

My spouse and I’ve been caring for our grandson 1 ½ days every week and have actually loved our time collectively attending to know one another. It brightens my day when he sees me and smiles.

To all you new fathers, like my son, who’re celebrating their first father’s day, I want you a HAPPY FATHER’S DAY. Care for the brand new particulars in your life and do your greatest to lift a contented, nicely rounded, and accountable grownup. That is likely one of the best joys in life.

Share this text: